What to do if you receive an IRS balance due notice for taxes you have already paid.- TAS

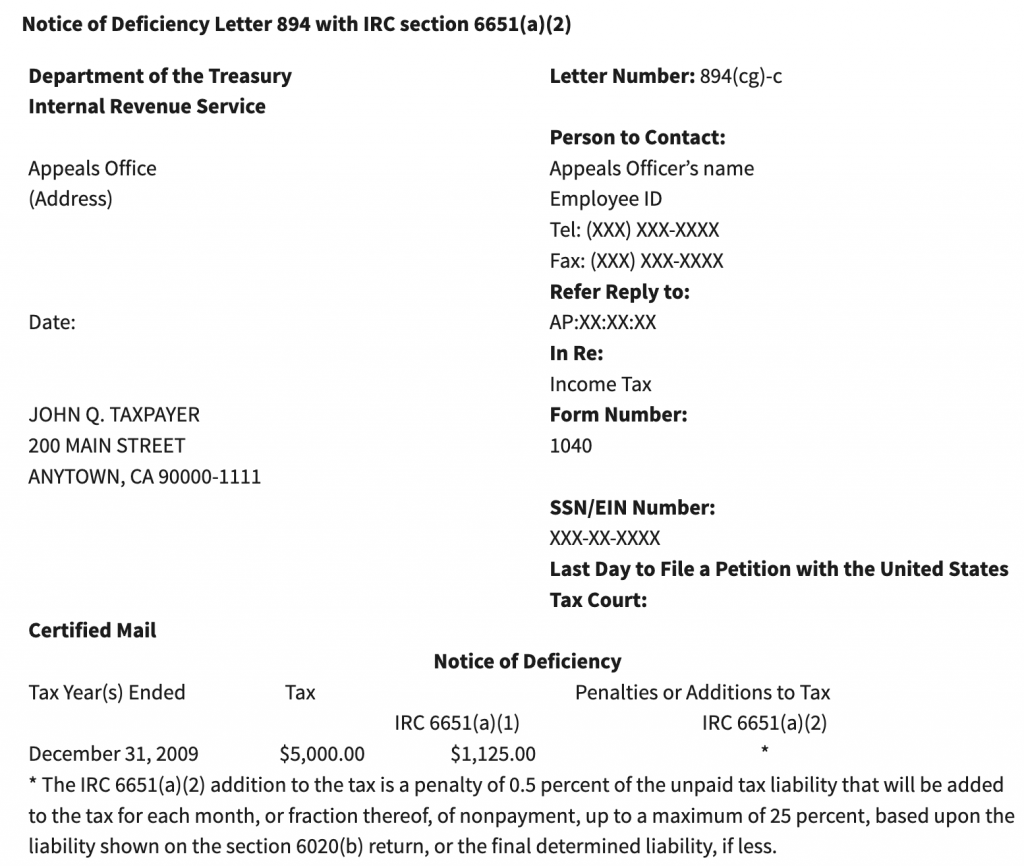

How to Respond to a Notice of Deficiency

Held or Stopped Refunds - Taxpayer Advocate Service

IRS to resume sending suspended tax notices - Don't Mess With Taxes

Notice CP14 - TAS

I Need Help Resolving My Balance Due - Taxpayer Advocate Service

Millions of Americans will receive important IRS letter this month - why ignoring it could cost you

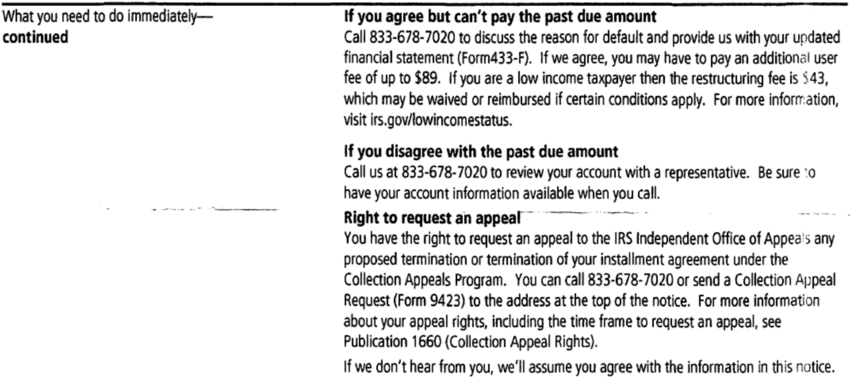

IRS Notice CP523: What To Do When the IRS Threatens to Terminate Your IA - Choice Tax Relief

Taxpayer Advocate Service: Assistance with a Notice of Deficiency - FasterCapital

IRS Letter 4464C: Help! Am I Being Audited?

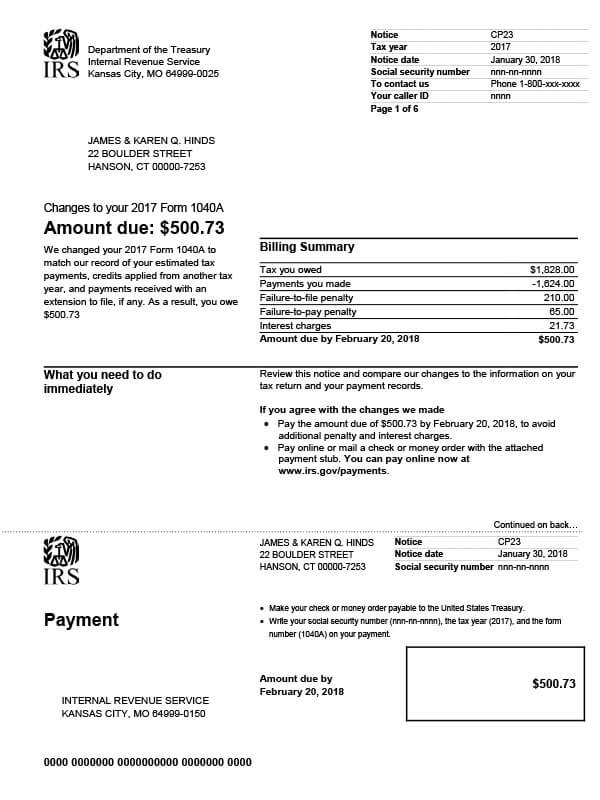

IRS Notice CP23 - Tax Defense Network

What to do if you receive an IRS balance due notice for taxes you have already paid.- TAS

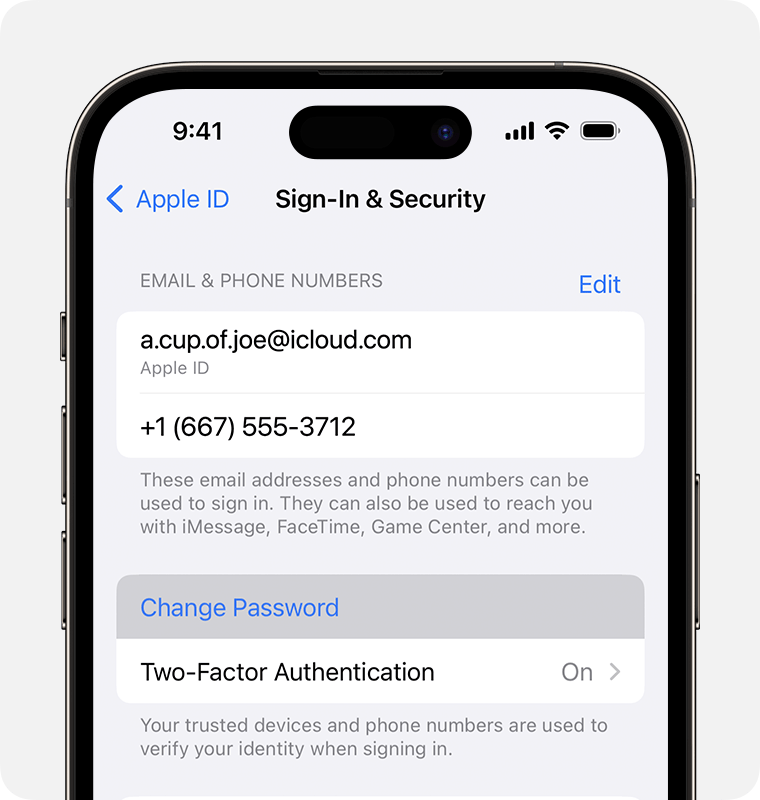

Online account frequently asked questions

IRS Notice CP14: What It Is and How to Respond - Choice Tax Relief

IRS Notice CP504: What It Is, What It Means, and How to Respond

:max_bytes(150000):strip_icc()/Supplements-You-Shouldnt-Be-Taking-if-You-Have-Diabetes-According-to-a-Dietitian-01-2000-7fd96fe376404680b8afaa32dfbdb673.jpg)